-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Corporate and business tax

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Tax compliance

Business Tax

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives program

Tax incentives program

-

Transfer Pricing Study

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Business Risk Advisory

Risk is inevitable but manageable. We deliver relevant, timely and practical advices to aid organizations manage risk and improve business performance. We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Technology Advisory

We provide comprehensive solutions to safeguard your business and ensure operational resilience and compliance. Our expert team offers a range of technology advisory services designed to address your cybersecurity needs, enhance business continuity, and manage security effectively.

-

Transactional advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

On September 27, 2022, the Puerto Rico Department of Treasury (“PRDT”) released Administrative Determination No. 22-08 (“DA”) to establish tax relief measures for taxpayers affected by the aftermath of Hurricane Fiona (“Hurricane)” in Puerto Rico.

The PRDT anticipates the challenges taxpayers may face in complying with their tax responsibilities due to interruptions in essential services such as electric power and internet that were caused by the Hurricane. As a result, the PRDT Secretary is exercising its power as vested by the 2011 Puerto Rico Internal Revenue Code, as amended (“the Code”) to extend deadlines for payments of tax as well as the fillings of any returns or statements.

The PRDT emphasizes that at the moment, all the services provided by the platform SURI are operating normally. Those taxpayers that are able can make tax debt payments, request automatic payment plans, and request certifications, among others.

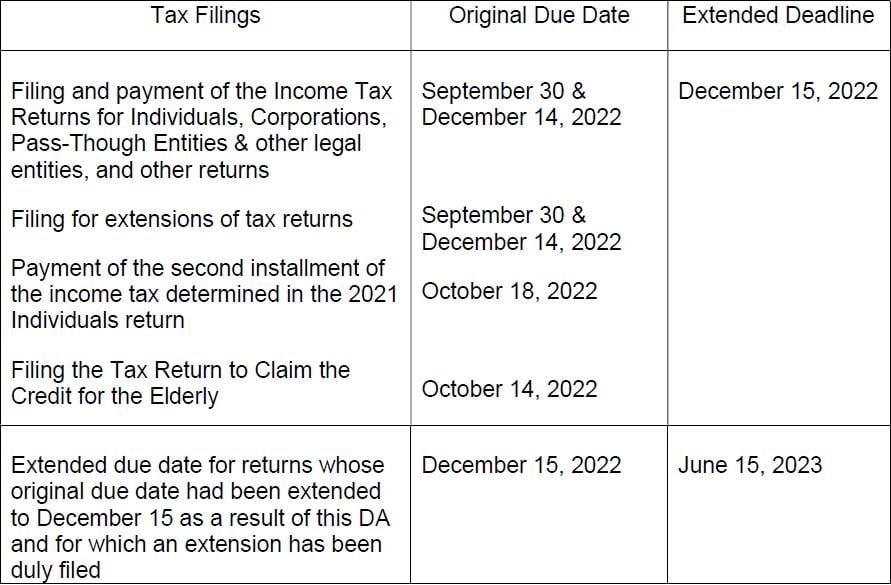

We have summarized below the key points and important dates of the tax administration measures implemented by the PRDT to grant taxpayers relief while they recover from the consequences of the Hurricane.

The following table portrays tax filings that were extended by the PRDT, along with the original and extended deadlines:

Other measures available to taxpayers:

- Request for tax payment plans– Taxpayers who have been economically affected by the Hurricane and are current on their payment plan may enter a new payment plan through SURI or by visiting the Collection's Office of the PRDT before December 31, 2022, if they are unable to meet an installment of their current plan due to the Hurricane.

- Automatic Grant of a Temporary Exempt Certificate to merchants with valid Reseller Certificates to exempt them from Sales and Use Tax (SUT) on any imports of taxable items for resale for the month of October 2022

- Allowance of special distributions from retirement plans and Individual Retirement Accounts (IRAs) due to Disaster Declared by the Governor of Puerto Rico from October 6, 2022, until December 31, 2022

- Activation of qualified payments made by the employer to its employees or contractors for help to overcome disasters. The period of time during which these qualified payments will be allowed to be excluded from the recipient’s gross income will be from September 19, 2022, to December 31, 2022

- Activation of the provisions that exclude from gross income loans to employees or independent contractors to cope with a Declared Disaster. The period of time for granting these qualified payments will be from September 19, 2022, to December 31, 2022