-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Corporate and business tax

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Tax compliance

Business Tax

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives program

Tax incentives program

-

Transfer Pricing Study

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Business Risk Advisory

Risk is inevitable but manageable. We deliver relevant, timely and practical advices to aid organizations manage risk and improve business performance. We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Technology Advisory

We provide comprehensive solutions to safeguard your business and ensure operational resilience and compliance. Our expert team offers a range of technology advisory services designed to address your cybersecurity needs, enhance business continuity, and manage security effectively.

-

Transactional advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

On March 22, 2020, various federal and state financial institution regulatory agencies issued an Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus.

The interagency statement provides the agencies’ views on whether loans restructured by creditors in response to COVID-19 are troubled debt restructurings (TDRs) under ASC 310-40, Receivables – Troubled Debt Restructurings by Creditors. The FASB has concurred with the accounting interpretation provided in the interagency statement.

Following the enactment of the CARES Act on March 27, 2020, however, the agencies revised their statement to address the interaction between Section 4013 of the CARES Act and the positions taken in the interagency statement. For more on Section 4013 of the CARES Act, see Snapshot 2020-14 “CARES Act addresses TDRs and CECL for banks.”

Interaction between interagency statement and CARES Act

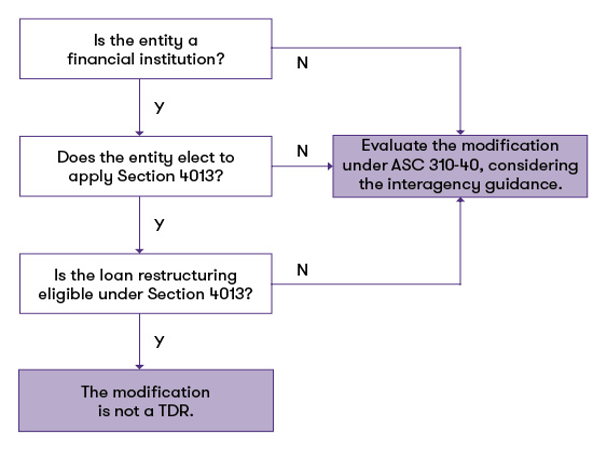

Section 4013 of the CARES Act provides financial institutions with an option to suspend the application of ASC 310-40 to eligible loan restructurings. A loan restructuring is eligible under Section 4013 if the restructuring is related to COVID-19, the loan was not more than 30 days past due as of Dec. 31, 2019, and the restructuring is executed between March 1, 2020, and the earlier of 60 days after the termination of the national emergency or Dec. 31, 2020.

Interaction between interagency statement and CARES Act Section 4013 of the CARES Act provides financial institutions with an option to suspend the application of ASC 310-40 to eligible loan restructurings. A loan restructuring is eligible under Section 4013 if the restructuring is related to COVID-19, the loan was not more than 30 days past due as of Dec. 31, 2019, and the restructuring is executed between March 1, 2020, and the earlier of 60 days after the termination of the national emergency or Dec. 31, 2020.

If a loan restructuring is not eligible under Section 4013, or if the financial institution does not elect to avail itself of the optional relief in Section 4013, the financial institution should evaluate the loan restructuring under ASC 310-40. However, like other entities, a financial institution evaluating a restructuring under ASC 310-40 may also consider the guidance in the interagency statement.

The following chart illustrates the interaction between Section 4013 and the interagency statement.

Identifying TDRs in ASC 310-40 Under ASC 310-40

A creditor who restructures a loan must evaluate whether the restructuring constitutes a TDR.

According to the Codification’s Master Glossary, a restructuring of a loan constitutes a TDR if the creditor, for economic or legal reasons related to the debtor’s financial difficulties, grants a concession to the debtor that it would not otherwise consider. Under the guidance in ASC 310-40, a restructuring is a TDR if both of the following conditions are met:

- the debtor is experiencing financial difficulty.

- the creditor has granted a concession to the debtor.

If restructuring the loan does not constitute a TDR, then the creditor must evaluate whether the restructuring results in a new loan, according to the guidance in ASC 310-20.

Evaluating financial difficulty

Pursuant to ASC 310-40-15-20, a creditor should consider the following conditions when evaluating whether a debtor is experiencing financial difficulty at the time of a loan restructuring:

- the debtor is currently in payment default on any of its debt, or it is probable that the debtor would be in default in the foreseeable future without the loan restructuring.

- the debtor has declared or is in the process of declaring bankruptcy.

- there is substantial doubt about the debtor’s ability to continue to be a going concern.

- the debtor’s securities have been, or are under threat of being, delisted.

- based on the debtor’s current capabilities, it will be unable to service all of its contractual debt payments.

- without the loan restructuring, the debtor could not obtain other financing on terms equal to those available to non-troubled debtors.

Evaluating whether a concession is granted

Under the guidance in ASC 310-40-15-13 through 15-17, a creditor has granted a concession to a debtor if the restructured terms are not consistent with market terms available to borrowers with similar credit risk.

However, a restructuring that only results in a delay in payment that is “insignificant,” as defined in ASC 310-40-15-17, is not a concession.

Interagency guidance

According to the interagency statement, short-term loan modifications made on a good faith basis in response to COVID-19 to borrowers who were current prior to the relief are not considered to be TDRs under ASC 310-40. Creditors may presume that a restructuring is not a TDR if the following criteria are met:

- the restructuring is in response to the COVID-19 national emergency.

- the borrower was current on payments (meaning less than 30 days past due on contractual payments) at the time the modification program is implemented.

- the restructuring is short-term (six months or less).

Qualifying restructurings may include payment deferrals, fee waivers, extension of repayment terms, or delays in payment that are insignificant.

Restructurings that do not meet the criteria above are not automatically considered TDRs but should be further evaluated under the guidance in ASC 310-40.

Federal or state-mandated restructurings

Restructurings or deferral programs mandated by the federal or state government related to COVID-19 are not within the scope of the TDR guidance in ASC 310-40.

Restructurings that are not TDRs

An entity should apply the guidance in ASC 310-20-35-9 through 35-12 to evaluate whether a restructured loan that is not a TDR should be accounted for as either (a) a new loan, or (b) a continuation of the original loan.

Restructured loans that are considered new loans

A restructured loan is accounted for as a new loan if both of the following conditions are met:

- the new loan’s effective yield (including any related premiums or discounts) is at least equal to the market yield for similar borrowers.

- the restructurings are more than “minor.”

Under the guidance in ASC 310-20-35-11, a restructuring is more than “minor” if the present value of the cash flows under the restructured terms is at least 10% different from the present value of the remaining cash flows under the terms of the original instrument. If the present value of the cash flows is not more than 10% different from the present value of the remaining cash flows under the terms of the original instrument, then a creditor must consider other relevant considerations surrounding the restructuring to determine if the restructuring is more than minor.

If a restructured loan is considered a new loan, any unamortized net fees or costs, and any prepayment penalties from the original loan, should be recognized in interest income when the new loan is granted.

Restructured loans that are not new loans

If the restructured loan is not accounted for as a new loan, it is accounted for as a continuation of the original loan. For these restructured loans, an entity must continue to amortize the unamortized net fees or costs from the original loan. Any prepayment penalties associated with the original loan must also be deferred and amortized into interest income with the net deferred fees or costs.

The investment in the new loan consists of the remaining net investment in the original loan, any additional amounts loaned under the restructuring, any fees received, and direct loan origination costs associated with the refinancing or restructuring.

Other financial reporting considerations

In addition to interpreting ASC 310-40 with regard to identifying TDRs, the interagency statement also addresses certain other financial reporting matters.

Past due reporting

For loans that are not otherwise reportable as past due, regulated financial institutions are not required to designate loans with deferrals granted in response to COVID-19 as past due because of such deferrals in their periodic regulatory reporting. A loan’s payment date is governed by the due date in the legal loan documents. If a lender defers payment, this may result in no contractual payments being past due, and such loans would not be considered past due during the period of deferral.

Additionally, the relief noted above regarding past due reporting would also apply for purposes of determining risk-based capital.

Risk-weighted capital relief

One-to-four family residential mortgage loans that are restructured in response to COVID-19 and are not determined to be TDRs under the interagency statement will not be considered restructured loans for purposes of determining risk-weighted capital, as long as the loans are prudently underwritten and are not past due or carried in nonaccrual status.

Nonaccrual status

Regulated financial institutions are generally not required to report loans subject to short-term deferrals prompted by COVID-19 as nonaccrual in their periodic regulatory reports if the loans would not otherwise be so classified.

However, if an entity has concerns about the realization of principal or interest, then interest income should not be recognized.

Source:

Grant Thornton, On the Horizon April 16, 2020