-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Corporate and business tax

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Tax compliance

Business Tax

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives program

Tax incentives program

-

Transfer Pricing Study

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Business Risk Advisory

Risk is inevitable but manageable. We deliver relevant, timely and practical advices to aid organizations manage risk and improve business performance. We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Technology Advisory

We provide comprehensive solutions to safeguard your business and ensure operational resilience and compliance. Our expert team offers a range of technology advisory services designed to address your cybersecurity needs, enhance business continuity, and manage security effectively.

-

Transactional advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

The world is going through an unprecedented health crisis due to Covid-19 and the economic future of several business has been jeopardized. For this reason, the President of the United States signed several Acts providing economic support and relief packages to the business sector.

Among this new legislation, we hereby discuss (A) Families First Coronavirus Response Act and (B) Coronavirus Aid, Relief, and Economic Security Act:

A. Families First Coronavirus Response Act

On March 18, 2020, the Families First Coronavirus Response Act was enacted to assist certain employers to provide employees with paid sick leave and expanded family, and medical leave regarding reasons related to COVID-19. The leave provisions are effective from April 1, 2020 through December 31, 2020.

This Act applies to employers with fewer than five hundred 500 employees. The Federal Secretary of Labor has the authority to issue regulations to exclude certain health care providers and emergency personnel from the definition of eligible employee, and to exempt small businesses with fewer than 50 employees from application where the imposition of such requirements jeopardizes the viability of the business.

It also applies to those employees affected due to a qualified need related to a public health emergency, which the law defines as an emergency with respect to COVID-19 declared by a federal, state or local authority, as of April 2, 2020 to 31 December 2020.

Family Leave

An eligible employee for this Act is one who has been employed by the employer to whom he or she applies for such leave for at least 30 calendar days.

This Act provides 12 weeks of protected leave, among other reasons, to an employee who cannot work or telework (remote work), for the care of a child under 18 years of age, whether the child's school (primary or secondary) or the place of care or the child care provider (a provider who receives compensation for providing childcare services on a regular basis) is not available due to a public health emergency.

The first 10 days (2 weeks) of leave are unpaid or paid, unless the employee decides to use that leave alongside another earned leave, according to the employer's regular policies. Therefore, it is only ten 10 weeks that must be paid to the qualified employee.

The remaining leave must be paid at no less than 2/3 of the employee's regular pay rate, the number of hours the employee would normally be scheduled to work (or the number of hours calculated), as long as the employer does not have to pay more than $200 per day or $10,000 in total per employee.

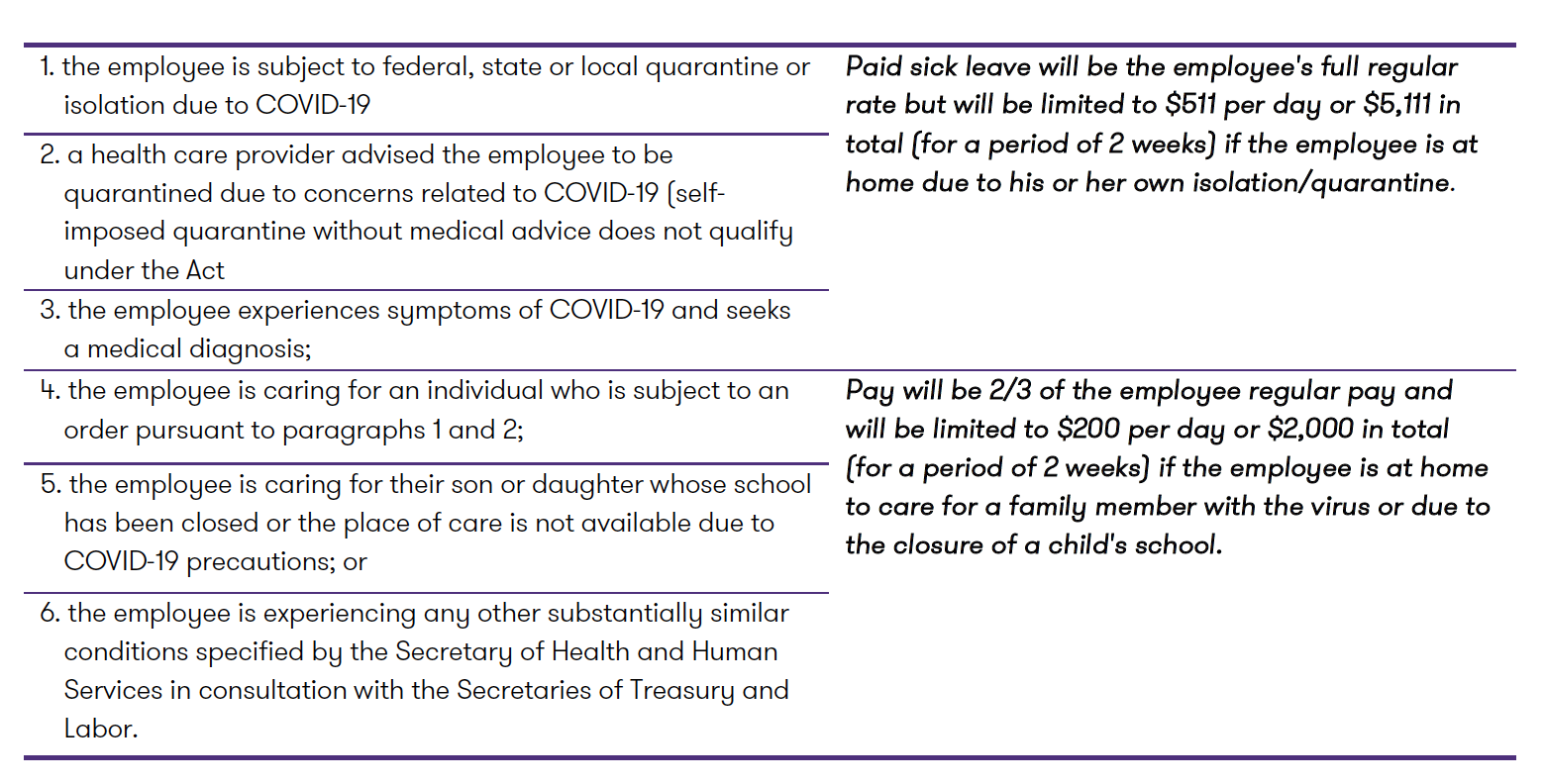

Emergency Paid Sick Leave

In general, the emergency paid sick leave law provides that an employer must provide paid sick leave when an employee is unable to work (including telework) because:

Regular employees will receive 80 hours of paid leave, while part-time employees receive the equivalent of the number of hours they would work, on average, over a 2-week period. Paid sick leave is available immediately and regardless of how long the employee has worked for his employer.

An employer may not require an employee to use other paid leave provided by the employer to the employee before the employee uses the paid sick time provided under this section for the reasons above.

Tax Credits for Paid Sick and Family and Medical Leave

Payroll tax credits for qualified sick leave wages and family leave paid by an employer shall be allowed in the amount of benefits paid (not to exceed the limits identified above for pay) over the permitted duration.

An individual tax credit for qualified sick leave and family leave for self-employed individuals in the amount of $200 per day (or $511 for emergency paid sick leave for own quarantine or seeking own medical diagnosis) or 67% (or 100% for emergency paid sick leave for own quarantine or seeking own medical diagnosis) of average daily pay for self-employed individuals over the permitted duration, whichever is less.

Any wages required to be paid by reason of the Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion Act shall not be considered wages for certain purposes.

B. Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) (discussion limited to Payment Protection Program and Employee Retention Credit)

On March 27, 2020, the CARES Act was enacted to help small businesses that have been economically affected due to Covid-19.

Paycheck Protection Program

Loans under the Paycheck Protection Program are 100% government guarantee.

Eligible borrower

The following business will be considered eligible borrowers:

- a small business with less than 500 employees (full-time, part-time or other basis)

- businesses that meets the SBA’s size standard (i.e. certain small businesses, Tribal business concern, veteran’s organization);

- an individual who operates as a sole proprietor, independent contractor or self-employed;

- businesses in the Accommodation and Food Services Sector (NAICS Code 72) – the 500 employee rule is applied on a per physical location basis;

- the affiliation rules are waived for businesses under NAICS Code 72, businesses operating as a franchise and businesses that received financial assistance from a company licensed under Section 301 of the Small Business Investment Act, therefore, they are considered an eligible recipient.

- 501(c)(3) non-for-profits organizations with less than 500 employees.

Lenders

In evaluating the eligibility of a borrower, a lender will consider whether the borrower was in operation on February 15, 2020 and had employees for whom they paid salaries and payroll taxes or paid independent contractors.

An eligible recipient should make a good faith certification that:

- the uncertainty of current economic conditions makes necessary the loan request to support the ongoing operations;

- acknowledge the funds will be used to retain workers and maintain payroll or make mortgage, lease and utility payments;

- it does not have an application pending for a loan and duplicative of amounts applied for or received under a covered loan; and

- from February 15, 2020 to December 31, 2020, the eligible recipient has not received a loan duplicative of the purpose and amounts applied for or received under a covered loan.

Maximum loans

The maximum loan amount available under this program is calculated as follows:

- 2.5 x the borrower’s average monthly payroll costs for costs incurred during the 1-year period before the date on which the loan is made, not to exceed $10 million.

- For businesses that did not operate during the period from February 15, 2019 to June 30, 2019, the maximum loan will be:

- 2.5 x the borrower’s average monthly payroll costs incurred for January and February 2020.

Payroll cost

The payroll costs will include the following:

- For employers: the sum of payments of any compensation with respect to employees that is a:

- salary, wage, commission, or similar compensation;

- payment of cash tip or equivalent;

- payment for vacation, parental, family, medical, or sick leave;

- payment required for the provisions of group health care benefits, including insurance premiums;

- payment of any retirement benefit; or

- payment of state or local tax assessed on the compensation of employees;

- For a sole proprietors, independent contractor and self-employed individuals: the sum of payments of any compensation to or income of a sole proprietor or independent contractor that is a wage, commission, income, net earnings from self-employment, or similar compensation and that is in an amount that is not more than $100,000 in 1 year, as pro-rated for the covered period.

For purposes of calculating the maximum loan amount, payroll costs do not include:

- the compensation of an individual employee in excess of an annual salary of $100,000, as prorated for the period February 15, 2020 to June 30,2020.

- any compensation of an employee whose principal place of residence is outside of the United States;

- qualified sick and family leave wages for which a credit is allowed under the Families First Coronavirus Response Act.

Loan forgiveness

This program allows for a loan forgiveness equal to the portion spent by the borrower on the following items during an 8-week period after the origination date of the loan:

- payroll costs;

- costs related to continuation of group health care benefits during periods of paid sick, medical, or family leave, and insurance premiums;

- employee salaries, commissions, or similar compensations;

- payments of interest on any mortgage obligation;

- rent, including rent under a lease agreement;

- utilities; and

- interest on any other debt obligations that were incurred before the covered period.

The borrower will have a portion of their loan forgiven in the amount equal to their payroll costs (not including costs for compensation amounts above the pro-rated share of wages exceeding $100,000 annually), interest payments on mortgages, rent payments, and utility payments between February 15, 2020 and June 30, 2020.

The amount of loan forgiveness will be reduced if there is a reduction in the number of employees or a reduction of greater than 25% in wages paid to employees.

Loans that have a remaining balance after forgiveness will have a maximum maturity of 10 years and an interest rate not to exceed 4%.

Employee Retention Credit

The Employee Retention Credit has been granted to encourage employers to keep employees on their payroll, despite experiencing economic hardship due to COVID-19.

Eligible employers

Employers eligible for the credit are going to be those that were operating during the year 2020 (including tax exempt 501(c) organizations) and meet either of the following conditions:

- the employer’s business operations have been fully or partially suspended due to government order; or

- the employer has a 50% decrease in gross receipts when compared to the same quarter in 2019. The credit does not apply to governmental employers and employers that receive Small Business Interruption Loans.

Credit amount

The employee retention credit is equal to 50% of qualified wages paid from March 13, 2020 until December 2020, up to $10,000 per employee. This credit can be credited against the employer’s 6.2% share of social security and the excess is refundable.

Qualified wages

For eligible employers with more than 100 full-time employees during the year 2019, the qualified wages are the wages paid to an employee that have not been providing services due to either: (1) the employer’s business operations have been suspended due to government order, or (2) the employer has a 50% decrease in gross receipts.

On the other hand, for eligible employers with less than 100 full-time employees during the year 2019, the qualified wages are the wages paid to an employee, regardless if the employee provided services or not.

For these purposes, qualified wages paid may not exceed the amount such employee would have been paid for working an equivalent duration during the 30 days immediately preceding such period. Qualified health plan expenses are considered qualified.

Special rule

To prevent a double benefit, the CARES Act states that any wages considered in determining the employee retention credit should not be consider for purposes of determining the credit allowed under the Employer Credit for Paid Family and Medical Leave. In addition, in a recent Q&A issued by the Internal Revenue Services it was clarified that Eligible Employer must choose between the Paycheck Protection Program and the Employee Retention Credit as both are mutually exclusive.

We are committed to keep you up to date with these tax-related developments. Please contact our Tax Department should additional information is required regarding this or any other tax issue. We will be glad to assist you.