-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Corporate and business tax

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Tax compliance

Business Tax

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives program

Tax incentives program

-

Transfer Pricing Study

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Business Risk Advisory

Risk is inevitable but manageable. We deliver relevant, timely and practical advices to aid organizations manage risk and improve business performance. We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Technology Advisory

We provide comprehensive solutions to safeguard your business and ensure operational resilience and compliance. Our expert team offers a range of technology advisory services designed to address your cybersecurity needs, enhance business continuity, and manage security effectively.

-

Transactional advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

On March 12, 2020, the Governor of Puerto Rico issued the Executive Order No. OE-2020-020, in which Puerto Rico was declared in a state of emergency given the imminent impact of the Coronavirus (Covid-19) in our Island.

In addition, on March 15, 2020, the governor issued Executive Order No. OE- 2020-023 establishing a 14 days curfew for the citizens, a closure of government operations, and the closure of all businesses in Puerto Rico from 6:00 p.m. from March 15, 2020 to March 30, 2020. All these measures were implemented, to prevent and control the spread of this virus with the promptness and efficiency it deserves.

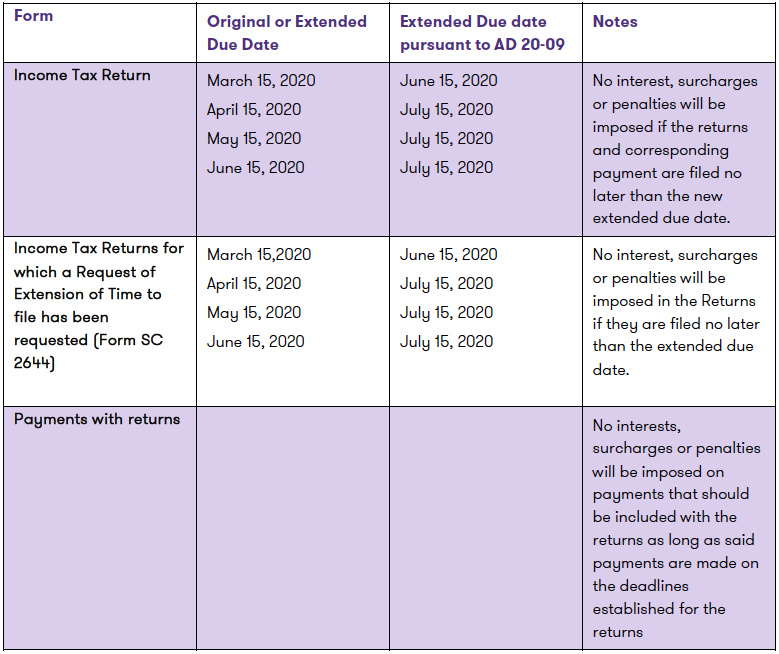

To avoid unreasonable setbacks to taxpayers regarding the fulfillment of their tax responsibilities, the Puerto Rico Treasury Department has issued AD 20-09 to inform the extension of certain tax returns, declarations and forms due dates. Administrative Determination 20-09 provides the following revised due dates:

Sales and Use Tax

Income Tax Returns

Informative Declarations

Other Tax Returns, Forms and Tax payments**

** Returns that are not related to Income Tax, Sales and Use Tax, Excise Taxes established in Subtitle C of the Code, the Taxes on alcoholic beverages established in Subtitle E of the Code, as well as the Special Tax on foreign corporations established under Act No. 154 of 25 of October 2010 or Informative Declarations.

Bonds

Internal Revenue Licenses

Kevane Grant Thornton will continue to work remotely during this time. Please contact our Tax Department should you require additional information regarding this or any other tax issue. We will be glad to assist you.