-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Corporate and business tax

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

International tax

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Tax compliance

Business Tax

-

Individual taxes

Individual taxes

-

Estate and succession planning

Estate and succession planning

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives program

Tax incentives program

-

Transfer Pricing Study

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Fraud and investigations

The commercial landscape is changing fast. An ever more regulated environment means organizations today must adopt stringent governance and compliance processes. As business has become global, organizations need to adapt to deal with multi-jurisdictional investigations, litigation, and dispute resolution, address the threat of cyber-attack and at the same time protect the organization’s value.

-

Dispute resolutions

Our independent experts are experienced in advising on civil and criminal matters involving contract breaches, partnership disputes, auditor negligence, shareholder disputes and company valuations, disputes for corporates, the public sector and individuals. We act in all forms of dispute resolution, including litigation, arbitration, and mediation.

-

Business risk services

We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Internal audit

We work with our clients to assess their corporate level risk, identify areas of greatest risk and develop appropriate work plans and audit programs to mitigate these risks.

-

Service organization reports

As a service organization, you know how important it is to produce a report for your customers and their auditors that instills confidence and enhances their trust in your services. Grant Thornton Advisory professionals can help you determine which report(s) will satisfy your customers’ needs and provide relevant information to your customers and customers’ auditors that will be a business benefit to you.

-

Transactional advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Mergers and acquisitions

Globalization and company growth ambitions are driving an increase in M&A activity worldwide as businesses look to establish a footprint in countries beyond their own. Even within their own regions, many businesses feel the pressure to acquire in order to establish a strategic presence in new markets, such as those being created by rapid technological innovation.

-

Valuations

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Recovery and reorganization

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

With the rising impact of COVID-19 being seen worldwide, all industries will face significant disruption to their supply chain, workforce and cashflow. The right response will depend on the specific circumstances you and your business face. However, when experiencing significant stress or distress, we recommend you focus everything you do around the management of cash.

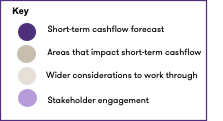

Our Resilience Wheel outlines five key considerations for businesses with cash management at the centre.

1. Cash management: the most critical issue for businesses

Take steps to retain cash in the business

This may include actions to:

- stretch creditor payments

- negotiate payment deferrals with landlords and banks where possible

- sweep idle cash from other facilities into your working capital account, or draw down on availability in your banking facilities

- negotiate with customers for them to pay early, by offering them a discount or other concessions

- explore tax concessions available

- investigate available government grants and

other support

Short to medium term cash forecasting is essential

Now more than ever you should create a robust cash forecast. The minimum expectation for most businesses should be a 12-14 week daily (or even weekly) forecast, monthly after that to the end of 2020. Profit & loss and cash flow should be integrated and cash balances reconciled.

Stakeholders who are contemplating providing financial assistance will not be able to support everyone to the same level. Having a robust plan underpinned by strong financial forecast will give comfort and clarity to the stakeholder, thereby maximising your opportunity to access the necessary funding.

The Resilience Wheel: focus on cash management

2. Contingency planning

Where are the critical points in your supply chain? Consider stock piling essential supplies (try to create and hold an emergency reserve of critical supplies), ensure alternative sources are identified.

Who are your essential employees? Establish staff support plans to allow them to continue working (childcare, flexible working, remote working).

Explore what reliance your business has on external support for any processes/interaction with other businesses (including the supply/delivery chain).

Consider whether part (or all) of your business should be suspended, and the implications in terms of deactivating equipment and dealing with live projects or work in progress.

Think about if employee absence could cause you to

miss a tax/regulatory filing deadline. Depending on your specific regulatory requirements, you may be able to delay audit dates or make arrangements for an audit using a virtual approach.

Look at the insurance cover you have and check whether you have a legitimate claim for the kind of disruption your business is currently facing. Similarly, check if a successful claim could be made against your business for the cancellation of services or goods.

3. Stakeholder management

A robust cash forecast will put you in a stronger position with your stakeholders. Be proactive and engage with tax authorities, lenders, landlords and key suppliers to avoid missing out on financial and other support that may be available.

4. People

Understanding your employees’ profile is critical; consider the flexibility you have to deploy people into different areas of your business.

In many cases workforce solutions can be negotiated, and a big part of this is active engagement with people, unions and other employee representatives to explore what options can be accommodated for each business. Engaging with your legal advisers early will help clarify the options available.

There is always going to be a sensitive balance between maintaining employment levels and the ultimate survival of the business.

Set a clear policy for people absence, covering voluntarily absence and for situations where people are quarantined or unwell.

Employees need to know where they stand and trust messages from their business leaders – tone, accuracy and relevance can make all the difference to behaviour.

5. Setting up a crisis management team

Ensure representation from key departments or groups and meet frequently to discuss and prioritise problems.

Wherever possible, try to anticipate the next problem

If you have spare resource, allocate some of it to a ‘hot planning’ group who can react and find solutions to individual problems as they emerge without tying up the whole management team.

Communicate early, often and frankly with the team. Establish a communication system which can reach staff at home or otherwise isolated. Lack of news breeds uncertainty and concern.