-

Financial statements audits

Financial statement audits

-

Compliance audits

Compliance audits

-

Compilations and reviews

Compilations and audit

-

Agreed-upon procedures

Agreed-upon procedures

-

Tax compliance

Business Tax

-

Global mobility services

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Sales and use tax and indirect taxes

SUT/ VAT & indirect taxes

-

Tax incentives

Navigating the complex landscape of tax incentives in Puerto Rico can be challenging. Whether you're looking to benefit from the Export Services Act (Act 20), the Individual Investors Act (Act 22), or other incentives under Act 60, we provide tailored advice to help you maximize your tax benefits and ensure compliance. Let us help you unlock the potential of doing business in Puerto Rico.

-

Transfer Pricing Study

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Business consulting

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

Business Risk Advisory

Risk is inevitable but manageable. We deliver relevant, timely and practical advices to aid organizations manage risk and improve business performance. We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

-

Technology Advisory

We provide comprehensive solutions to safeguard your business and ensure operational resilience and compliance. Our expert team offers a range of technology advisory services designed to address your cybersecurity needs, enhance business continuity, and manage security effectively.

-

Transactional advisory services

Transactions are significant events in the life of a business – a successful deal that can have a lasting impact on the future shape of the organizations involved. Because the stakes are high for both buyers and sellers, experience, determination and pragmatism are required to bring deals safely through to conclusion.

-

Forensic and investigative services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

History of blockchain

Blockchain was developed as the technology principle that sits behind the first crypto currency to go mainstream: Bitcoin.

Created by Satoshi Nakamoto – whose identity has never been revealed – released the whitepaper Bitcoin: A Peer to Peer Electronic Cash System in 2008 that described a “purely peer-to-peer version of electronic cash” known as Bitcoin, blockchain technology made its public debut.

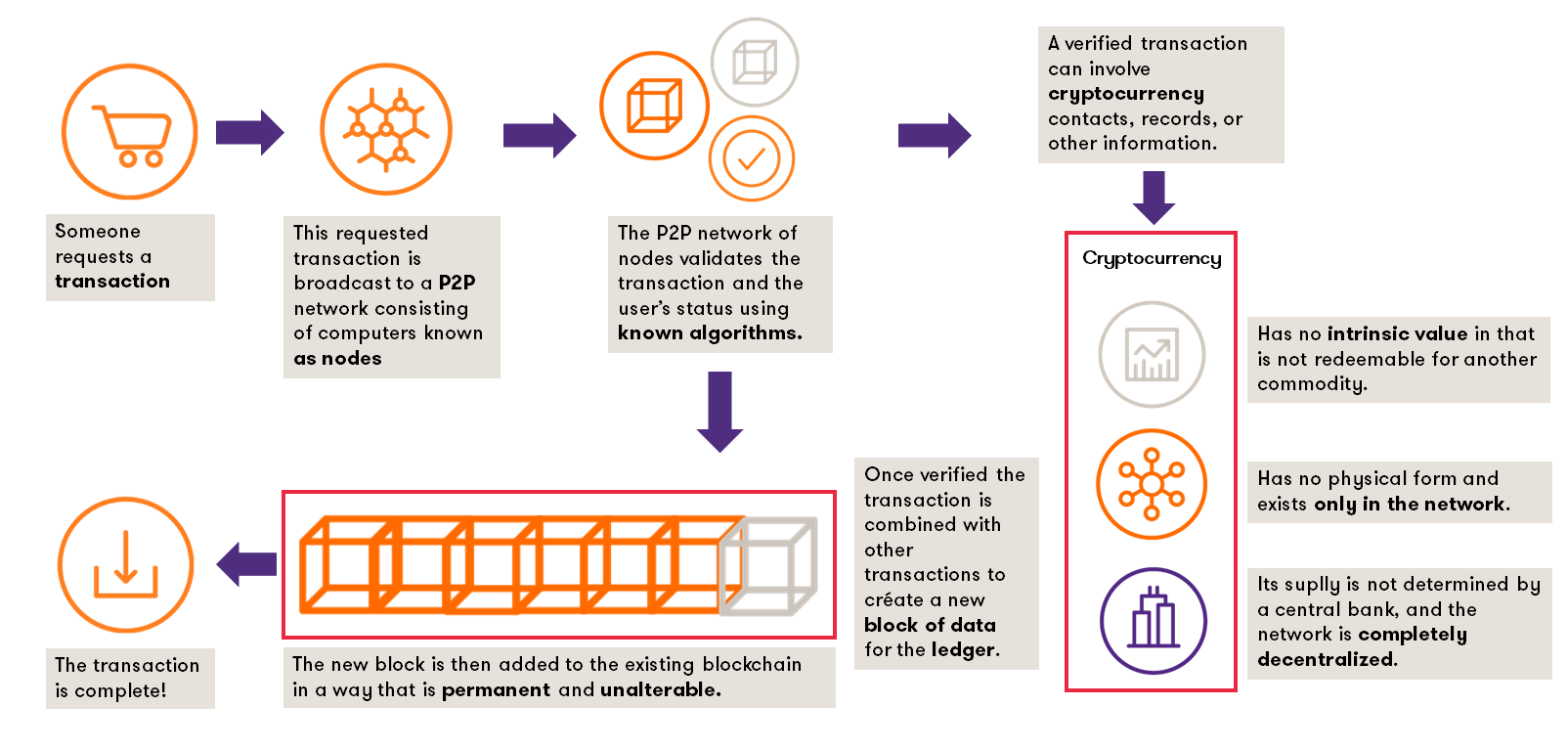

What is blockchain?

The blockchain is, as Business Insider defined it: “A ledger of all transactions, owned and monitored by everyone but ultimately controlled by none. It's like a giant interactive spreadsheet everyone has access to and updates to confirm each digital credit is unique.”

The potential of blockchain, the technology, has far exceeded the value of Bitcoin, the currency – best demonstrated by the fall in the value of Bitcoin as interest in, and development of, the technology has risen.

While there are many potential uses of the blockchain, its initial focus was to create a platform capable of making Bitcoin payments that are freely, openly and securely transferred without the need for central control.

How does it work?

A blockchain is a single ledger that records transactions between organizations, their suppliers and customers. An audit trail is created as data is added in linked “blocks” and as more information is added, a chain of blocks is built. Everybody with permission to join the blockchain can see the same information in real time. Following a list of benefits of the blockchain:

- you can see who added each block, and at what time. Blocks can’t be removed or changed.

- all users – rather than just one controller – own the blockchain, and they are all responsible for maintaining it.

- in a private blockchain, the users decide who can join the ledger and their level of access. Some information can be encrypted to protect commercial confidentiality.

- a company could have a blockchain with a supplier, with a client, with its bank and with the tax office.

How it could potentially impact the financial statements audit?

Some publications have hinted that blockchain technology might eliminate the need for a financial statement audit by a CPA auditor altogether. If all transactions are captured in an immutable blockchain, then what is left for a CPA auditor to audit?

An audit involves an assessment that recorded transactions are supported by evidence that is relevant, reliable, objective, accurate, and verifiable. The acceptance of a transaction into a reliable blockchain may constitute sufficient appropriate audit evidence for certain financial statement assertions such as the occurrence of the transaction (e.g., that an asset recorded on the blockchain has transferred from a seller to a buyer). For example, in a bitcoin transaction for a product, the transfer of bitcoin is recorded on the blockchain. However, the auditor may or may not be able to determine the product that was delivered by solely evaluating information on the Bitcoin blockchain.

In other words, a transaction recorded in a blockchain may still be:

- unauthorized, fraudulent or illegal

- executed between related parties

- linked to a side agreement that is “off-chain”

- incorrectly classified in the financial statements

Furthermore, many transactions recorded in the financial statements reflect estimated values that differ from historical cost. Auditors will still need to consider and perform audit procedures on management’s estimates, even if the underlying transactions are recorded in a blockchain.

They will also need to evaluate management’s accounting policies for digital assets and liabilities, which are currently not directly addressed in international financial reporting standards or in U.S. generally accepted accounting principles. They will need to consider how to tailor audit procedures to take advantage of blockchain benefits as well as address incremental risks.

Evolution of the audit with blockchain

In a blockchain world, the CPA auditor could have near real-time data access via read-only nodes on blockchains. This may allow an auditor to obtain information required for the audit in a consistent, recurring format. By giving CPA auditors access to unalterable audit evidence, the pace of financial reporting and auditing could be improved. In addition, for areas that become automated, they will also need to evaluate and test internal controls over the data integrity of all sources of relevant financial information.

Potential opportunities for future roles of the CPA

- auditor of smart contracts and oracles

- service auditor of consortium blockchains

- administrator function

- arbitration function

Resources:

“Blockchain Technology and Its Potential Impact on the Audit and Assurance Profession” by Chartered Professional Accountants of Canada (CPA Canada) and the American Institute of CPAs (AICPA).

“A Beginner’s Guide to the Blockchain” by Grant Thornton UK

“Blockchain: How does it work?” by Grant Thornton Cambodia

Image - “What is Blockchain Technology?” by Blockgeeks

We are committed to keep you updated of all developments that may affect the way you do business in Puerto Rico. Please contact us for further assistance in relation to this or any other matter.