Collaborators:

Javier Oyola, Director, Tax

Diana Pacheco, Staff, Tax

In Puerto Rico, the treatment of manufacturer’s rebates and warranties affects the sales price of tangible personal property and its corresponding Sales and Use Tax (“SUT”). Despite the fact that the Puerto Rico Treasury Department published guidance on this matter, sellers and buyers had different views on how to treat the rebates and warranties when computing the sales price of a transaction, which in turn resulted in discrepancies over the accuracy of the seller's SUT calculation.

To address this, the Puerto Rico Government amended the “sales price” definition available in the Puerto Rico Internal Revenue Code of 2011, as amended (“the Code”), and the Puerto Rico Treasury Department issued various Regulations to the Code, providing guidance on the topic. This amendment and Regulations intend to add clarity and are crucial for understanding the requirements and staying in compliance with the tax authorities. In the following sections, we will discuss the relevant provisions in the law and regulations that discuss the interplay between the rebates and the sales price.

Rebates

The Puerto Rico SUT regulations do not contain a specific article related to rebates. Instead, rebates are discussed as part of the definition of sales price under Article 4010.01(ee)-1 of Regulation 8747 of 2016. Specifically, sub-section (c)(1) indicates that sales price will exclude the following:The Puerto Rico SUT regulations do not contain a specific article related to rebates. Instead, rebates are discussed as part of the definition of sales price under Article 4010.01(ee)-1 of Regulation 8747 of 2016. Specifically, sub-section (c)(1) indicates that sales price will exclude the following:

- The discounts allowed by the seller and used by the purchaser at the time of sale, including cash discounts, coupons, rebates, or any other mechanism that reduces the sales price, except those through which the seller receives a rebate from a third party. Therefore, to be applicable, a discount shall be granted at the time of the sale. Because discounts for prompt payment are not granted at the time of the sale, a discount for prompt payment shall have no effect whatsoever on the sales price.

As stated above, the general rule is that the sales price excludes rebates. However, under the above exclusion, the seller does not discount the rebate from the taxable sales price if the rebate comes from a third party. Consequently, according to the Regulations, in those cases where a third party will pay a rebate to the seller, the Puerto Rico SUT will be based on the total price before the discount. In these cases, the buyer will benefit only from the discount on the purchase price due to the rebate but does not enjoy a discount on the SUT because the taxable sales price doesn’t exclude the rebate that the manufacturer will pay the seller.

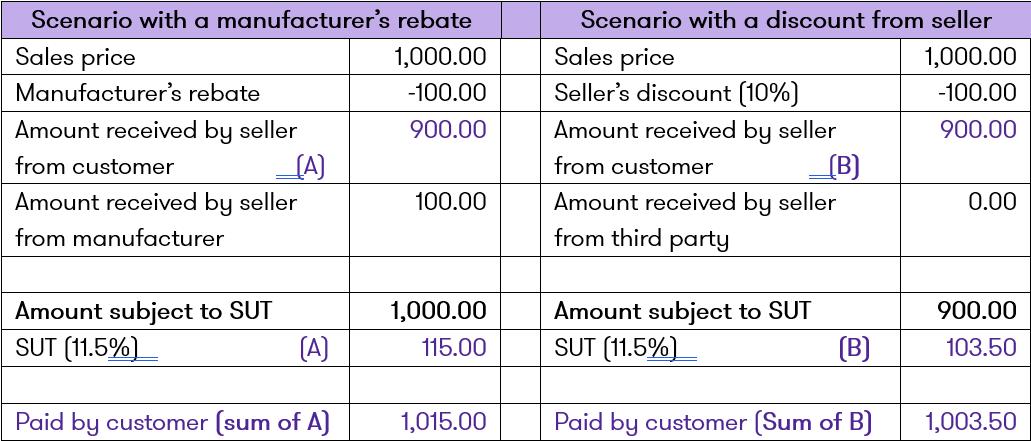

On the other hand, if the seller directly grants a discount (not a manufacturer’s rebate) at the time of the sale, such discount is reduced from the sales price, and the SUT is computed on the discounted sales price. The regulations allow the seller to exclude the discount from the taxable sales price because it is available and used at the time of sale, and the seller will not receive any portion of the sales price from the manufacturer. The following is an example to show the difference between the two scenarios based on the Regulations.

As can be noted in the above example, the difference between the amounts paid by the buyer is the tax corresponding to the hundred dollars ($100.00) that the manufacturer will pay to the seller.

Manufacturer’s rebates are strategic financial incentives in the sales price of a product, offered by the manufacturers and producers to the end consumer. The strategy behind the discounts or reductions is to stimulate sales and customer loyalty by appealing to buyers’ objectives for savings without directly impacting the purchase price.

Definition of Sales Price

According to Section 4010.01(ee) of the Code, “sales price” is defined as the total amount of consideration paid in money, credit, property, or services in a sale of taxable items with certain exclusions. Examples of these exclusions include discounts, including cash discounts or coupons not reimbursable by third parties, and warranties or extended warranty services.

Discounts (i.e., coupons) are only excluded from the sales price if they are used by the buyer and seller at the time of the sale. Consequently, if a third party grants the discount at a later date, the sales price remains unchanged, and the seller must pay SUT on the original sales amount.

The approval of Act 257 of 2018, resulted in a turning point regarding the topic of discounts and rebates as it amended Section 4010.01(ee) of the Code, which defines the term “Sales Price”. With this amendment, Act 257 of 2018 establishes that if the retailer sells a product that includes a manufacturer’s or wholesaler’s discount at the time of sale, Section 4010.01(ee)(2)(A)(i) of the Code mandates that the manufacturer or wholesaler reimburses the retailer for the discount, plus an additional amount equal to the SUT that would have been owed on the discounted amount. This ensures that the retailer receives all the SUT on the sales price. However, the major difference with this amendment is the fact that the customer is supposed to pay the SUT on the discounted sales price and not on the total value of the items prior to the rebate as the 2016 Regulations indicate.

Having discussed the treatment of rebates, we will now navigate how the regulations treat warranties for SUT purposes.

SUT Treatment on Warranties

Under Article 4010.01(nn)-1 of Regulation 8942, all services rendered to any person, including but not limited to the repair of tangible personal property, are considered taxable services. To understand how the SUT applies to warranties, the Regulation provides the following example in Article 4010.01(nn)-1(a)(5)(i)(B):

Example 1: “A” purchases a computer which comes with a manufacturer's warranty of one (1) year that covers parts and services. Six (6) months later, the computer was damaged. Business “B”, which is located in Puerto Rico, provides warranty services to the manufacturer. “B” does not resell parts and paid the use tax on the import of the parts. “B” renders repair services to “A” valued at three hundred dollars ($300.00) (two hundred dollars ($200.00) for parts and one hundred dollars ($100.00) for the service), which were not billed to “A”. “A” shall not be subject to the payment of SUT on the parts and service, because they are covered by the warranty. “B”, at the time of billing its services to the manufacturer, shall invoice the SUT on the repair services and in the case of the parts, the SUT paid on the import of the parts may be transferred as a cost component in the invoice.

In the above example, the end user (purchaser of the computer) will not have to pay SUT on warranty services or the parts since they are covered by the warranty. The warranty service provider will collect the SUT related to the repair services performed in Puerto Rico from the manufacturer and will also pass the SUT corresponding to the parts as a cost component. This reinforces the fact that even though there is an exemption for the end user, the services provided by the warranty service provider are considered taxable services, but the manufacturer will be the party responsible for the payment of the SUT to the service provider.

Also, Article 4010.01(ee)-1 of Regulation 8747, defines “sales price” and establishes in sub-section (c)(5) that all the services that are part of the sale, such as warranty services and extended warranty services should be excluded from the definition of sales price as long as they are considered insurance according to Article 4010.01(nn)-1 of the Regulation. However, it also clarifies that the fact that a service is not included in the sales price does not mean that it is not a taxable service. Consequently, each transaction must be analyzed to determine the correct tax treatment. The Regulation provides two examples to expand the explanation:

Example 2: Merchant “X” is engaged in the sale of computers. A manufacturer's warranty of one (1) year (considered insurance under Article 4010.01(nn)-1 of this Regulation) is included with the sale of a computer. The value of both the computer and the warranty shall be included in the sales price of this transaction because they were not segregated. [Example 1 of Article 4010.01(ee)-1(c)(5)(i)(A)]

Example 3: Same facts as in example #1, except that merchant “X” offers an extended warranty (also considered insurance under Article 4010.01(nn)-1 of this Regulation) which is charged separately from the computer. The value of the extended warranty shall not be included in the sales price of this transaction. [Example 2 of Article 4010.01(ee)-1(c)(5)(i)(B)]

The difference between both examples is that example #2, constitutes a combined transaction in which the amounts corresponding to each item (property and services) could not be identified, and consequently, it is taxed in its total amount. On the other hand, example #3, presents a segregation of the value of the computer and the extended warranty. Like example #1, example #3 shows a situation where the end user will not be charged for SUT on the purchase of the warranty since it is considered insurance.

In addition to the above, Article 4210.01(c)-5 of Regulation 8746 establishes exclusions and exemptions to the SUT in all its variations (Regular SUT, B2B and designated professional services). Among those exemptions, we must highlight that sub-section (a)(4) establishes an exclusion/exemption for insurance services, including issuing insurance policies such as extended warranty and warranty service contracts. Therefore, the issuance of insurance contracts such as warranties is not taxable for Puerto Rico SUT purposes.

Manufacturer rebates and warranties significantly influence consumer behavior, market dynamics, and economic activity in Puerto Rico. The correct implementation of the rules for rebates and warranties can lead to positive outcomes for both consumers and businesses and reduce risks related to the incorrect application of the local tax rules.

Be advised that this article considers the SUT implications of warranty contracts according to the Code and its regulations. For specific legal advice or assistance regarding other topics related to warranty contracts in Puerto Rico, we recommend consulting with a local attorney who specializes in consumer protection law.

As always, we are committed to keeping you up to date with all tax-related developments. Please contact our Tax Department for additional information regarding this or any other tax issue. We will be glad to assist you.

Our team of tax experts is available to assist you in the negotiation of a Voluntary Disclosure Agreement with the Puerto Rico Department of the Treasury or if an audit process already started, guide and support you through the audit to ensure a smooth resolution. Contact us today to learn more about how we can help you.