Authors:

Roxanna Saldaña Casillas, Supervisor, Tax

Yarelis Febus Collazo, Semi Senior, Tax

Excise taxes play a fundamental role in Puerto Rico's fiscal policy, impacting both individuals and businesses across various sectors. Understanding the complexities of these taxes, along with available exemptions and strategic management approaches, is essential for maintaining compliance and optimizing financial strategies.

Excise taxes in Puerto Rico are specific taxes imposed on the sale, use, consumption, importation, or manufacture of certain goods. They are different from income taxes and sales and use taxes, focusing on targeted items. These items are detailed in Sections 3020.01 through 3020.12 of Subtitle C, Chapter 2. of the Puerto Rico Internal Revenue Code of 2011, as amended, (“PR Tax Code”). All sections cited below are in relation to the PR Tax Code.

Nuances of Excise Taxes in Puerto Rico

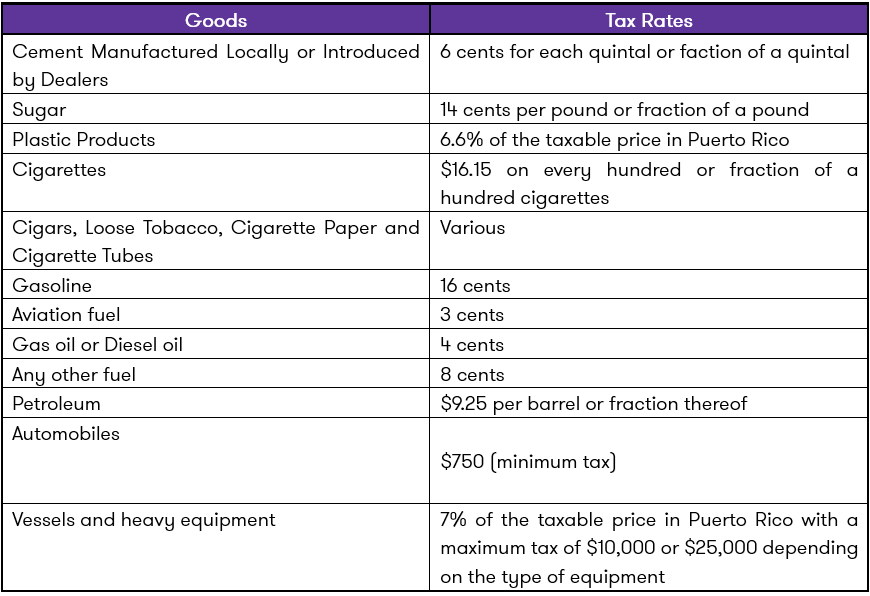

In the table below, we have summarized the most common goods and their tax rates for a quick reference:

Exemptions and Special Considerations

For the benefit of merchants in Puerto Rico, certain goods and businesses may qualify for exemptions and special considerations under Subtitle C, Chapter 3. The Puerto Rico Department of the Treasury grants exemptions to eligible taxpayers, either through refunds or the privilege of exempting payment responsibilities. These exemptions encompass various entities or goods such as:

- Manufacturing plants

- Importers of goods

- Nonprofit institutions

- Alternative fuel vehicles

- Goods in transit for re-export or return

- Public carrier vehicles

- Goods designated for manufacturing purposes

Under Section 3020.10, importers are required to file an Excise Tax Return detailing goods imported from abroad along with the corresponding tax payment. The declaration deadline coincides with the payment due date, with exemptions for bonded dealers importing vehicles, vessels, and heavy equipment, and merchandise imported by mail and air carrier.

Excise taxes applicable to imported goods must be paid in accordance with Section 3060.01(b), as follows:

- Before the taxpayer takes possession of the product.

- Goods introduced by mail: No later than the fifth (5th) business day following the day of arrival.

- Goods introduced by a person arriving from abroad: No later than the fifteen (15th) business day following the day of arrival in Puerto Rico.

- Goods introduced by a bonded importer: No later than the tenth (10th) day of the following month after taking possession. For vehicles, the tax payment is due within six months of introduction or within fifteen (15) days of sale or use, whichever occurs first.

For goods manufactured in Puerto Rico, the tax shall be paid no later than the tenth (10th) day of the month following the manufacturing period, in accordance with Section 3060.02(b).

Regulatory and Compliance Challenges

Effective management of excise tax costs requires businesses to adopt strategic approaches that ensure compliance and minimize financial risks. A key strategy involves implementing robust compliance procedures to facilitate accurate reporting and timely payment of excise taxes. Businesses should maintain accurate records and leverage digital platforms to enhance efficiency in tax management. These practices facilitate meeting regulatory requirements and streamline operations, by reducing the risk of penalties or legal issues.

Excise taxes in Puerto Rico represent a critical component of fiscal policy. Therefore, businesses can navigate regulatory challenges effectively while optimizing financial outcomes, by understanding the nuances of excise taxes, leveraging available exemptions, and implementing strategic tax management practices. Practical engagement with legal and tax advisors, combined with adherence to compliance best practices, ensures sustainable business operations in a dynamic tax environment. By staying informed and active, businesses can not only manage excise tax costs effectively but also contribute to broader economic development goals in Puerto Rico.