This article was prepared by:

Ashly Lasanta, Supervisor, Tax

Yarixa Garcia, Senior, Tax

It’s been almost two years since Act 52-2022 introduced a noteworthy change to Puerto Rico's income tax regime by adopting the Disregarded Entity (DE) treatment. This change aligns Puerto Rico’s taxation treatment of single-member entities with the one established by the U.S. federal tax code for DE. Its purpose is to foster local parity for owners who have elected this option for their entities in the U.S. One key aspect to consider is that certain local rules for DEs may differ from the ones established in the U.S.

Back in 2022, the particularities regarding DEs were in the newborn stage. To clarify the tax implications of DE and provide the ground rules on the treatment of certain transactions with them, the Puerto Rico Department of the Treasury (“PRTD”) issued Administrative Determinations 22-10 (DA 22-10) and 23-01 (DA 23-01). In our previous article, Puerto Rico Opens Its Doors to Disregarded Entities we explained that despite the initial clarification, Act 52, and the issued guidance, some matters still needed clarification.

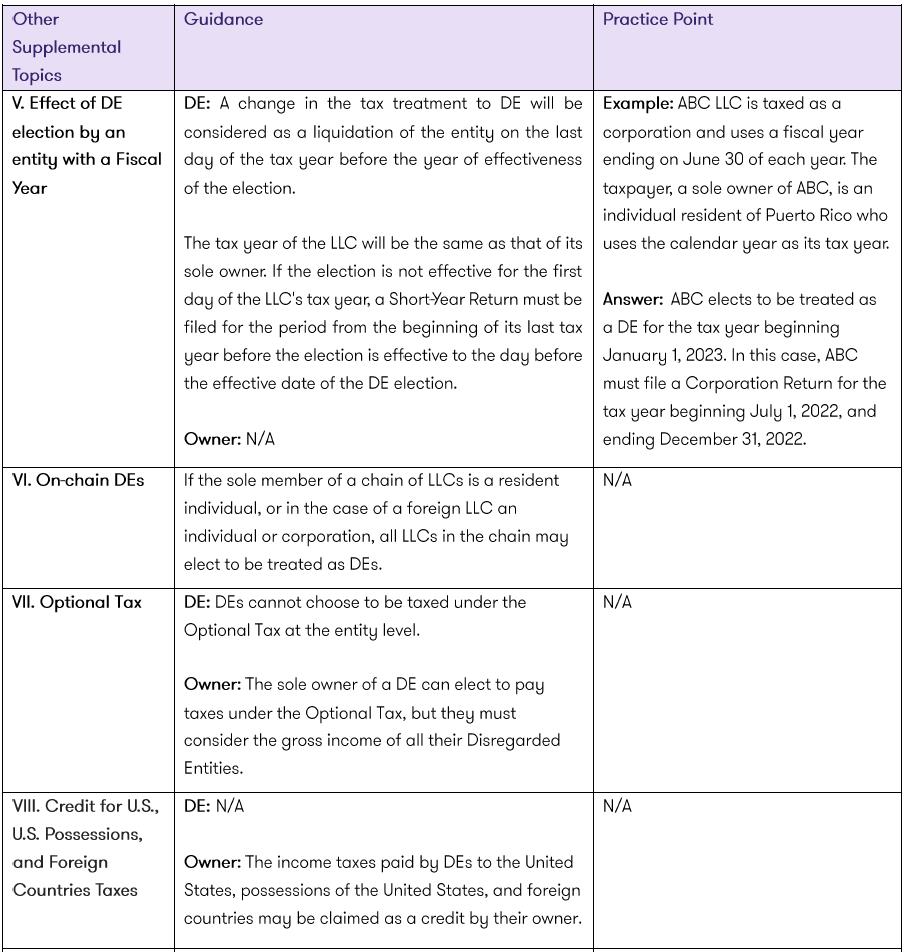

On January 30, 2024, the PRTD issued Circular Letter 24-02 (CL 24-02) to complement previous guidance and clarify aspects that remained open on the tax treatment of DEs. This letter addressed the following matters:

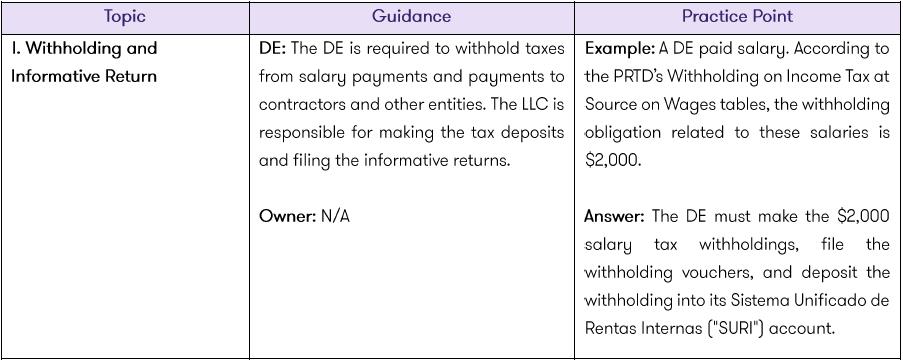

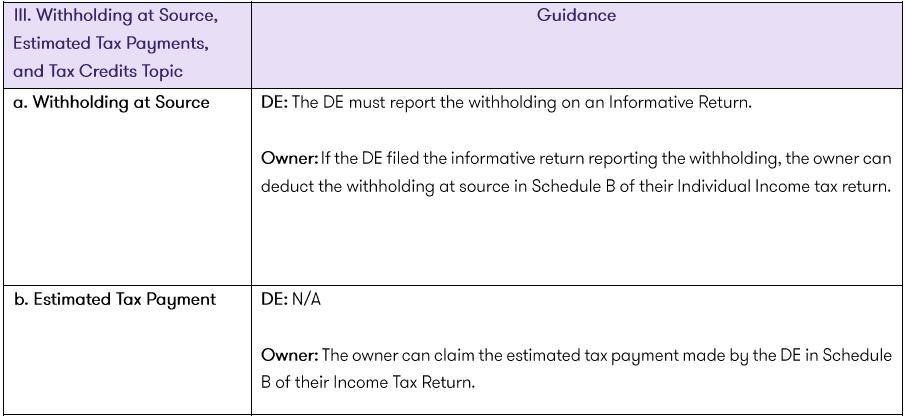

- (i) The obligation of the DE to withhold the tax at source and file the corresponding withholding vouchers and informative returns.

- (ii) How the DE owner can claim withheld taxes made to the DE and estimated tax payments made by the DE during the tax year on their income tax return.

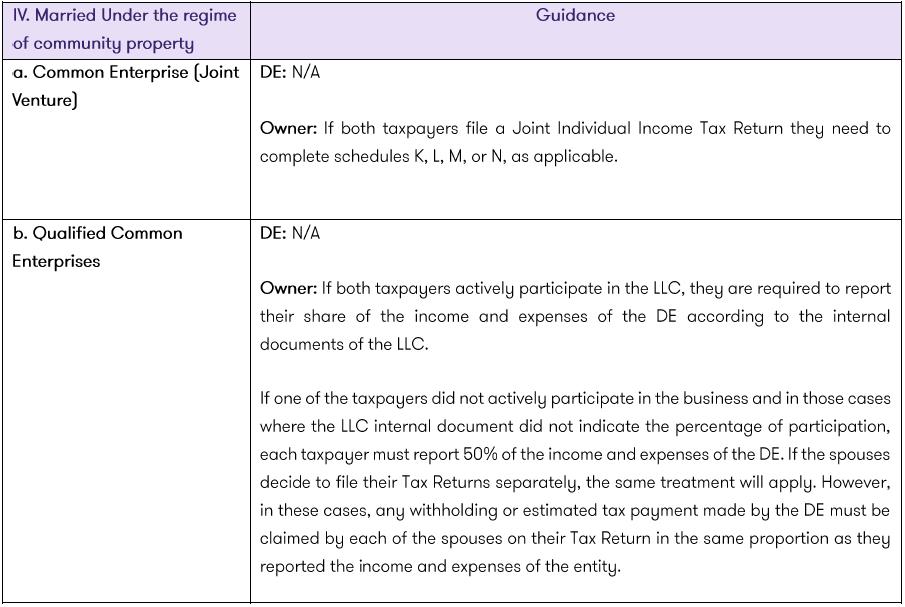

- (iii) How the DE owner married under the community property regime should report the operations of a DE when filing jointly with their spouse.

- (iv) The effect of an entity’s election of a DE with a fiscal year.

- (v) The operations of a DE that are considered as "Principal Industry or Business" when the sole owner is an individual.

Additionally, CL 24-02 clarifies the treatment of:

- (vi) DEs in a chain structure;

- (vii) Optional tax under Sections 1021.06 and 1022.07 of the Puerto Rico Internal Revenue;

- (viii) Credit for Contributions from the United States, Possessions, and Foreign Countries; and

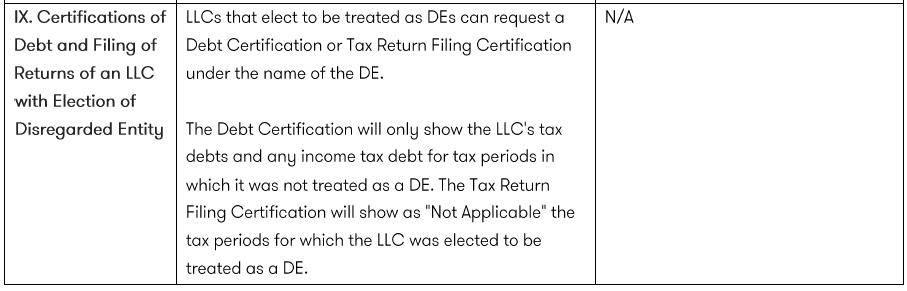

- (ix) Debt Certifications and Filling Requirements for LLCs with the DE election.

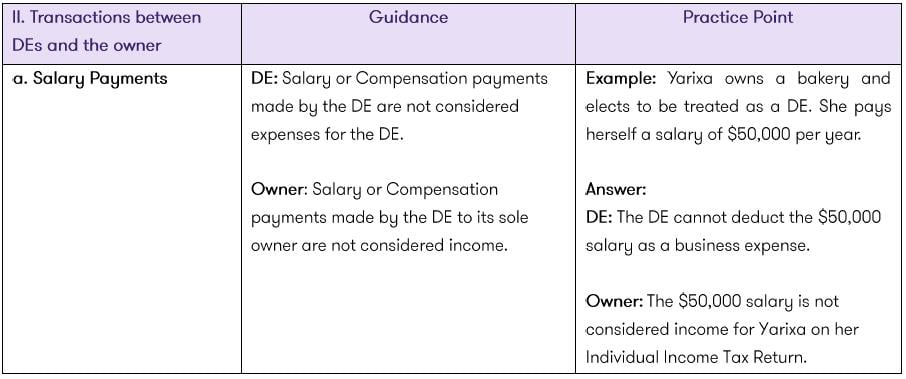

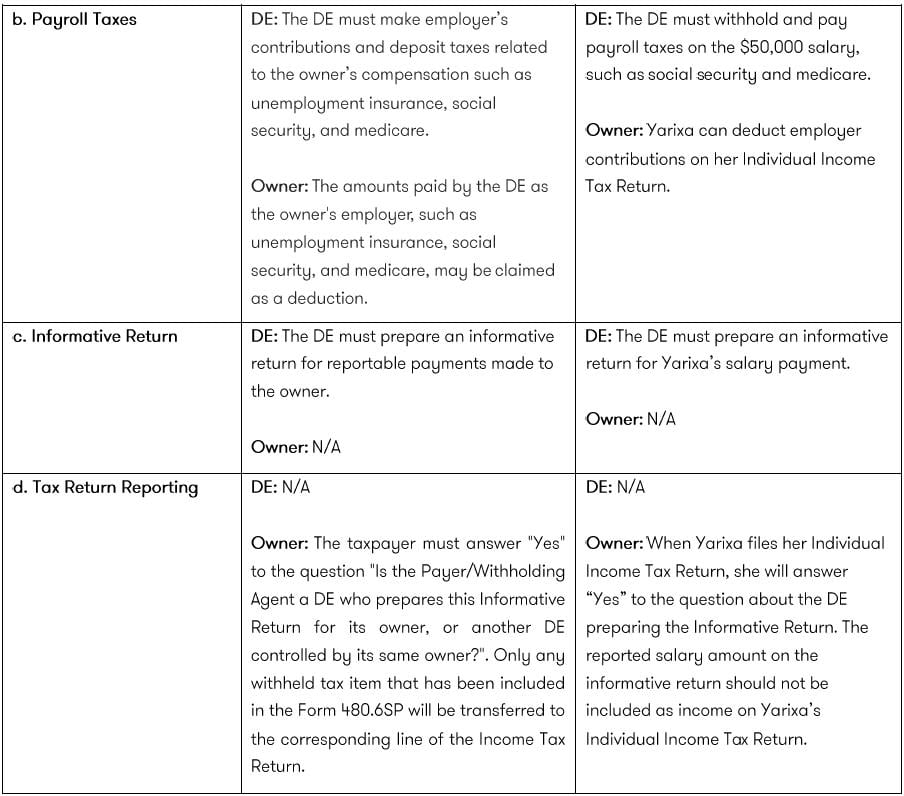

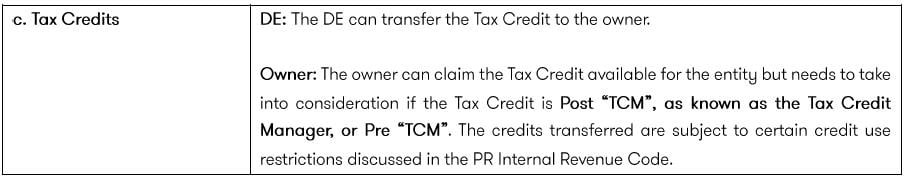

We have summarized these relevant topics in the table below to serve as a quick reference guide. We have segregated the implications of several topics between the entity and the owner.

Bottom line

The recent publications issued by the Puerto Rico Treasury on DEs offer valuable insights and considerations for taxpayers evaluating business structuring options. Careful evaluation is essential when determining the most appropriate business structure for your specific needs. Our team of tax professionals is available to assist you in evaluating whether a DE is the optimal choice for your organization. Please contact our Tax Department should you require additional information regarding this or any other tax issue.